Your CIBIL score, also known as your credit score, is a vital financial indicator that lenders use to assess your creditworthiness. It plays a crucial role when you apply for a personal loan or any other form of credit. A higher CIBIL score can not only increase your chances of loan approval but also help you secure lower personal loan interest rates. In this article, we will explore the steps you can take to improve your CIBIL score before applying for a personal loan, and how it can impact your borrowing experience.

Understanding the Significance of CIBIL Score

What is a CIBIL Score?

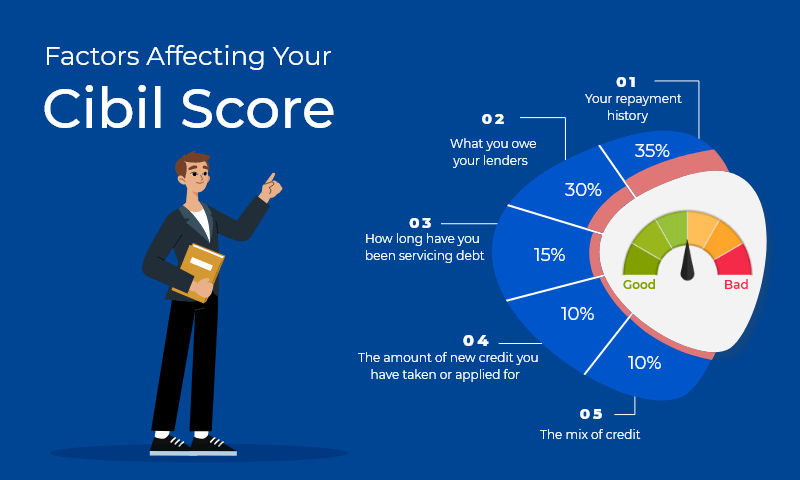

A CIBIL score is a three-digit numerical representation of your creditworthiness. It is based on your credit history, which includes your repayment behavior on loans and credit cards, credit utilization, and other financial transactions. In India, CIBIL (Credit Information Bureau India Limited) is one of the leading credit bureaus that calculates and maintains credit scores.

The Impact of CIBIL Score on Personal Loan Interest Rates

Your CIBIL score has a direct influence on the interest rates you’ll be offered when applying for a personal loan. Here’s how it works:

High CIBIL Score: Lenders view individuals with high CIBIL scores as low-risk borrowers. As a result, they are more likely to offer them personal loans at lower interest rates, as they believe these borrowers are less likely to default on their payments.

Low CIBIL Score: Conversely, a low CIBIL score suggests a higher credit risk. Lenders may still offer personal loans to individuals with low scores, but the interest rates are usually higher to compensate for the perceived risk.

Steps to Improve Your CIBIL Score Before Applying for a Personal Loan

- Review Your Credit Report

The first step in improving your CIBIL score is to review your credit report from CIBIL or any other credit bureau. This report will provide insights into your credit history, including any late payments, defaults, or errors that may be affecting your score. Check for inaccuracies and dispute any discrepancies you find.

- Pay Your Bills on Time

One of the most critical factors in determining your CIBIL score is your payment history. Consistently paying your credit card bills and loan EMIs on time can have a positive impact on your score. Set up reminders or automatic payments to ensure you never miss a due date.

- Reduce Outstanding Debt

High credit card balances relative to your credit limit can negatively affect your CIBIL score. Aim to reduce your outstanding debt by making more substantial payments than the minimum required. This not only improves your score but also saves you money on interest payments.

- Avoid Multiple Credit Inquiries

Every time a lender checks your credit report, it results in a hard inquiry, which can slightly lower your score. Limit the number of credit inquiries, especially when you’re planning to apply for a personal loan. Multiple inquiries in a short period can signal financial distress to lenders.

- Maintain a Mix of Credit

A diversified credit portfolio that includes a mix of credit cards and loans can positively influence your CIBIL score. However, avoid taking on additional credit just for the sake of diversity. Only apply for credit when you genuinely need it.

- Do Not Close Old Credit Accounts

The length of your credit history is a factor in your credit score. Closing old credit accounts can shorten your credit history, which may negatively impact your score. Keep your older credit accounts open, even if you’re not actively using them.

- Settle Outstanding Debts and Negotiate with Lenders

If you have any outstanding debts or accounts in collections, consider settling them or negotiating with the lenders. Once settled, make sure the lender updates your credit report to reflect the debt as “paid” or “settled.” This can have a positive impact on your credit score over time.

- Use Credit Wisely

Be mindful of how you use credit. Avoid maxing out your credit cards, and try to keep your credit utilization ratio below 30%. Responsible credit usage demonstrates financial discipline and positively affects your CIBIL score.

Applying for a Personal Loan with a Improved CIBIL Score

Once you’ve taken the necessary steps to improve your CIBIL score, you can confidently apply for a personal loan. Here are some additional tips to consider during the application process:

- Research Personal Loan Options

Before applying for a personal loan, research various lenders and their loan products. Compare interest rates, loan tenures, and terms and conditions. Choose a loan that best fits your financial needs and offers competitive interest rates.

- Apply for an Affordable Amount

When applying for a personal loan, only request the amount you genuinely need. Applying for a more substantial loan than necessary can lead to higher monthly payments and increased financial strain.

- Prepare Required Documents

Lenders typically require documents such as proof of identity, address, income, and bank statements when processing a personal loan application. Ensure you have all the necessary documents in order to expedite the application process.

- Evaluate Loan Offers Carefully

Once you start receiving loan offers, review them carefully. Pay attention to the interest rate, processing fees, prepayment charges, and any other associated costs. Choose the offer that provides the most favorable terms.

- Apply Online for Convenience

Many lenders offer the option to apply for personal loans online. This can be a convenient and time-saving method, allowing you to submit your application and documents electronically.

Conclusion

Your CIBIL score is a crucial factor when applying for a personal loan, as it directly influences the interest rates you’ll be offered. By taking proactive steps to improve your credit score, such as paying bills on time, reducing outstanding debt, and maintaining a diverse credit mix, you can enhance your creditworthiness and increase your chances of securing a personal loan with favorable terms.

Before applying for a personal loan, be sure to research your options, compare offers from different lenders, and choose the loan that best aligns with your financial goals. With an improved CIBIL score and careful consideration of your loan options, you can embark on a borrowing journey that suits your needs and sets you on the path to financial success.